Understanding the IRS income tax refund process for 2026 helps taxpayers set realistic expectations and avoid misleading claims about exact payout dates. Refund timing is not based on a fixed calendar; it depends on how and when a return is filed, accuracy checks, and banking processes. This article explains the simple, verified refund timeline, how the Internal Revenue Service processes returns, and the most common factors that affect when refunds are received.

Is There an Official IRS Refund Schedule for 2026

The IRS does not publish a guaranteed refund schedule with specific dates. Refunds are issued on a rolling basis after a return is accepted and processed. Any source claiming exact refund dates for all taxpayers in 2026 should be treated cautiously unless confirmed by the IRS.

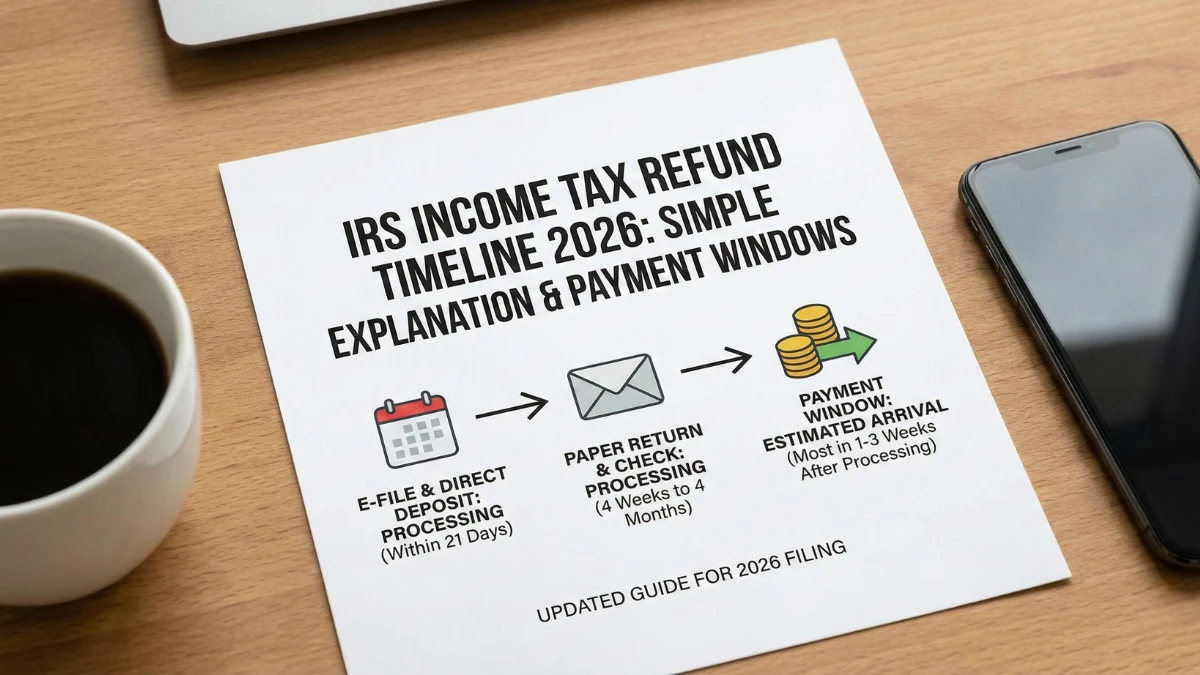

Estimated Refund Timing Based on Filing Method

| Filing Method | Typical Timing After Acceptance |

|---|---|

| E-file + direct deposit | Around 21 days |

| E-file + paper check | Longer than direct deposit |

| Paper-filed return | Several weeks or more |

| Amended return | Much longer processing |

| Return under review | Timing varies |

How the IRS Processes Refunds

After a return is accepted, the IRS verifies income, withholding, and credits, then checks for errors or mismatches. Only after these steps are completed is a refund released. Even returns filed on the same day can finish processing at different times.

Common Reasons Refunds Take Longer

Refunds may take longer due to errors, missing information, identity verification, amended returns, or credits that require extra review. These delays are procedural and not related to new payment rules.

How to Track Your Refund

Taxpayers can track refund progress using official IRS tools once the return is accepted. Status updates reflect processing stages and should not be confused with approval of new payments or benefits.

Key Facts

- The IRS does not guarantee refund dates

- E-filing with direct deposit is usually fastest

- Paper and amended returns take longer

- Reviews and corrections commonly cause delays

- Only IRS tools provide accurate refund status

Conclusion

The 2026 IRS income tax refund timeline follows established processing practices, not a fixed schedule. While many refunds are issued within a few weeks of acceptance, timing varies based on filing method and return accuracy. Relying on official IRS guidance helps taxpayers avoid confusion and plan realistically.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund timelines depend on individual filings, IRS procedures, and official government operations.