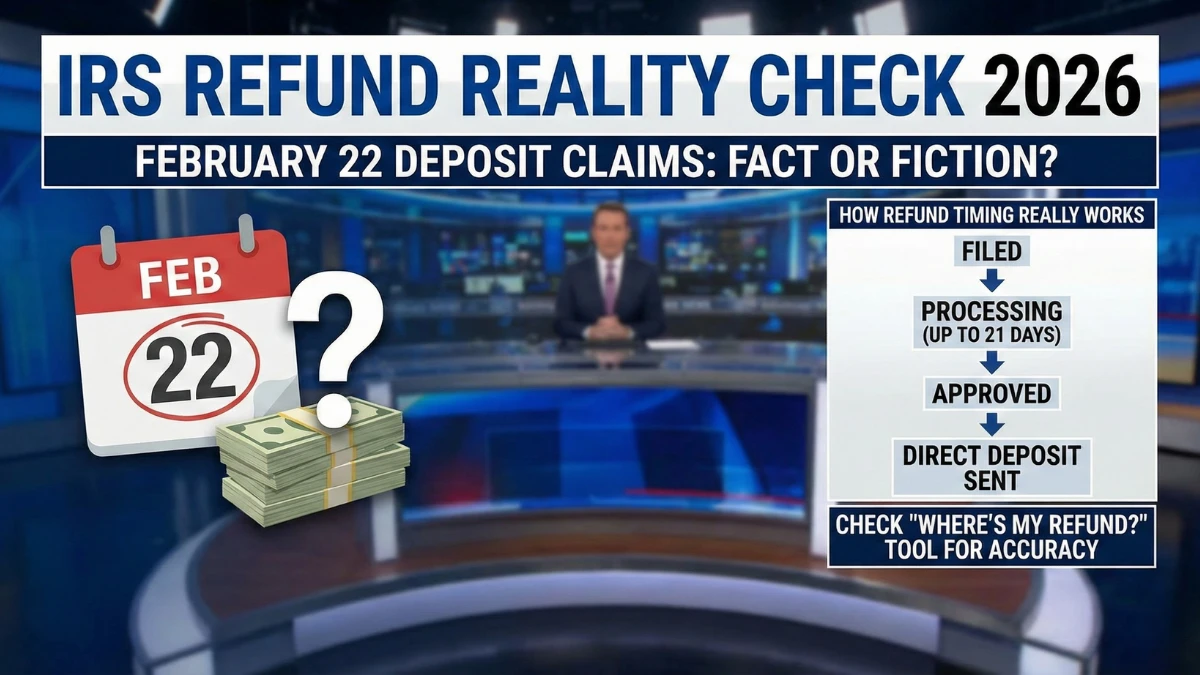

Online claims about IRS refund deposits arriving on 22 February 2026 have prompted many U.S. taxpayers to search for confirmation of refund amounts and timelines. To avoid misinformation, it is important to understand that the Internal Revenue Service does not release refunds based on a single nationwide date. This article explains the verified refund process, what a February 22 reference may actually indicate, and how taxpayers should interpret refund timing in 2026.

Is February 22, 2026 an Official IRS Refund Date

No. The IRS has not announced 22 February 2026 as a universal refund deposit date. Refunds are issued on a rolling basis after tax returns are accepted and processed. Any claim suggesting that all or most refunds will arrive on a specific February date is not supported by official IRS guidance.

Why February 22 Appears in Refund Discussions

Late-February dates are often mentioned because many early filers who submit accurate electronic returns with direct deposit may receive refunds around that time. However, this is a pattern based on processing speed, not an official schedule or guarantee.

Estimated Refund Timing Based on Filing Method

| Filing Method | Typical Timing After Acceptance |

|---|---|

| E-file with direct deposit | Around 21 days |

| E-file with paper check | Longer than direct deposit |

| Paper-filed return | Several weeks or more |

| Amended return | Significantly longer |

| Return under review | Timeline varies |

How Refund Amounts Are Determined

Refund amounts are not fixed or date-based. They depend on income, tax withheld, credits claimed, deductions, filing status, and life changes such as dependents. Two taxpayers filing on the same day can receive very different refund amounts and timelines.

Common Reasons Refunds Are Delayed

Refunds may take longer due to errors, missing information, identity verification, amended returns, or credits requiring additional review. These delays are routine and not connected to new payment programs or special February releases.

How and When Refunds Are Sent

Once approved, refunds are issued by direct deposit, paper check, or prepaid debit card based on the option selected during filing. Direct deposit is typically fastest, but banks control final posting times.

How Taxpayers Should Track Refund Status

Taxpayers should rely on official IRS refund tracking tools after their return is accepted. Status updates reflect processing stages and should not be confused with announcements of new or special payments.

Key Facts

- There is no official IRS refund date of 22 February 2026

- Refunds are issued on a rolling basis, not all at once

- Direct deposit and e-filing are usually fastest

- Refund amounts vary by individual tax situation

- Only official IRS tools provide accurate refund status

Conclusion

Claims about IRS refunds arriving specifically on 22 February 2026 should be understood as estimates based on typical processing timelines, not official payment dates. Refund timing and amounts depend on how and when a return is filed and whether additional review is required. Accurate information will always come from official IRS guidance.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund timing and amounts depend on individual filings, processing procedures, and official government rules.