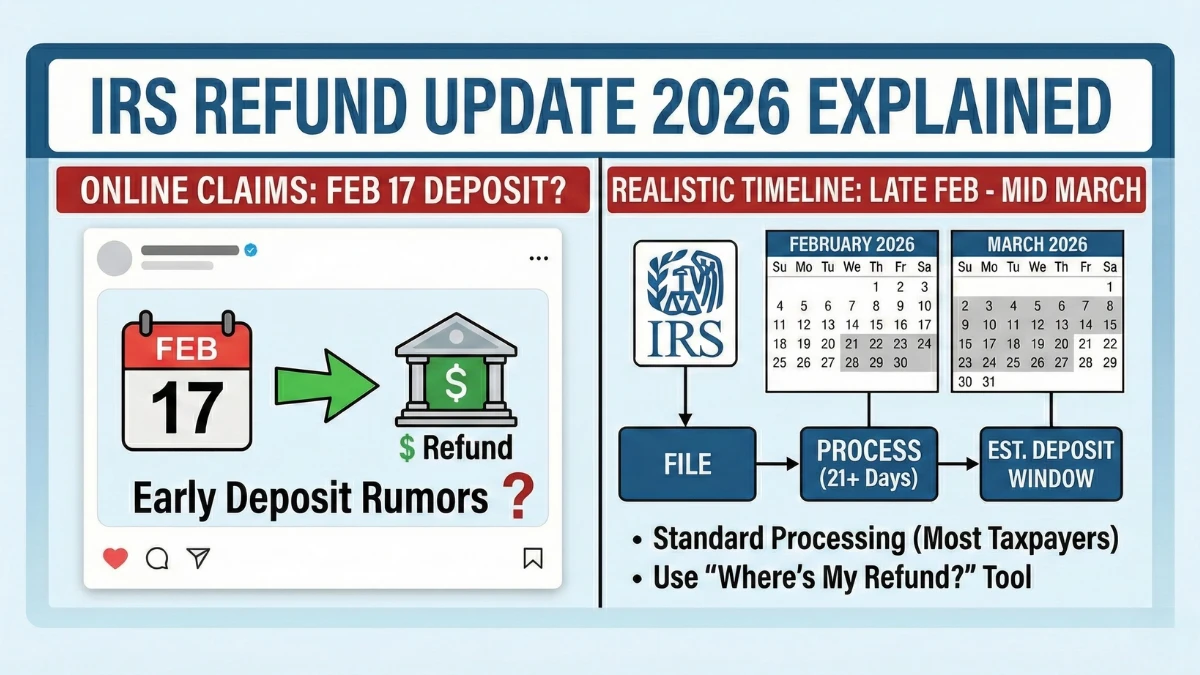

Searches for a 17 February 2026 IRS refund deposit have increased, but it’s important to separate estimated timelines from official announcements. The Internal Revenue Service does not publish single-date refund schedules for all taxpayers. This article explains what a February 17 reference usually represents, how refund processing actually works in 2026, and what taxpayers should realistically expect.

Is February 17, 2026 an Official IRS Refund Date

No. The IRS has not designated 17 February 2026 as a universal refund deposit date. Refunds are issued on a rolling basis after returns are accepted and processed. Any claim that all or most refunds arrive on a specific date is not supported by official IRS guidance.

Why February 17 Appears in Refund Discussions

Mid-February dates often appear because many early filers who submit accurate e-filed returns with direct deposit may see refunds around that time. This reflects typical processing speed—not an announced payment date or guarantee.

Estimated Refund Timing Based on Filing Method

| Filing Method | Typical Time After Acceptance |

|---|---|

| E-file + direct deposit | Around 21 days |

| E-file + paper check | Longer than direct deposit |

| Paper-filed return | Several weeks or more |

| Amended return | Significantly longer |

| Return under review | Timing varies |

What Affects When Your Refund Is Paid

Refund timing depends on filing accuracy, verification checks, identity confirmation, credits claimed, and IRS workload. Even returns filed on the same day can complete processing at different times.

Refund Amounts: Why They Differ

Refund amounts are based on income, withholding, credits, deductions, and filing status. There is no standard refund amount tied to any specific February date.

Common Reasons for Delays

Delays often occur due to errors, missing information, identity verification, amended returns, or credits that require extra review. These are routine checks, not special February payment rules.

How Refunds Are Issued

Once approved, refunds are sent by direct deposit, paper check, or prepaid debit card, depending on the option selected. Banks control final posting times, which can affect when funds appear.

How to Track Your Refund

Taxpayers should use official IRS tracking tools after their return is accepted. Status updates show processing stages and should not be confused with announcements of new or special payments.

Key Facts

- There is no official IRS refund date of 17 February 2026

- Refunds are issued on a rolling basis

- E-filing with direct deposit is usually fastest

- Refund amounts vary by individual return

- Only official IRS tools provide accurate status

Conclusion

References to February 17, 2026 reflect estimated timing based on typical processing, not an official IRS refund date. Actual payment timing and amounts depend on individual filings and verification steps. Reliable updates come only from official IRS guidance.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund timing and amounts depend on individual returns, IRS procedures, and official government rules.