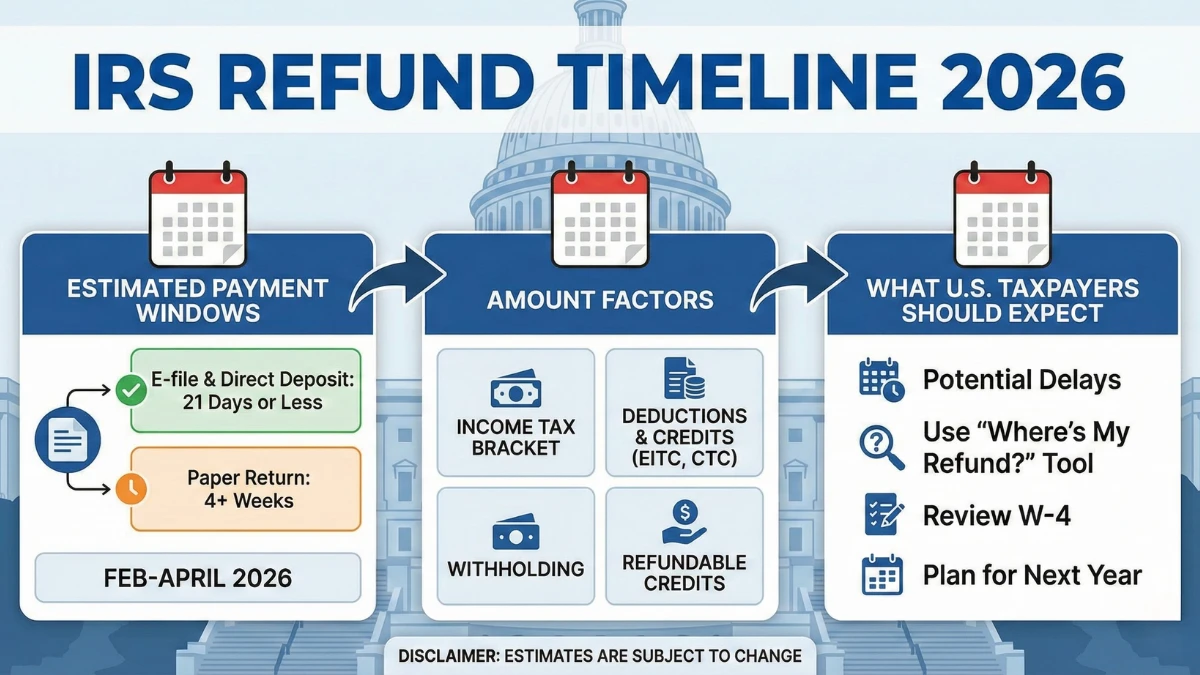

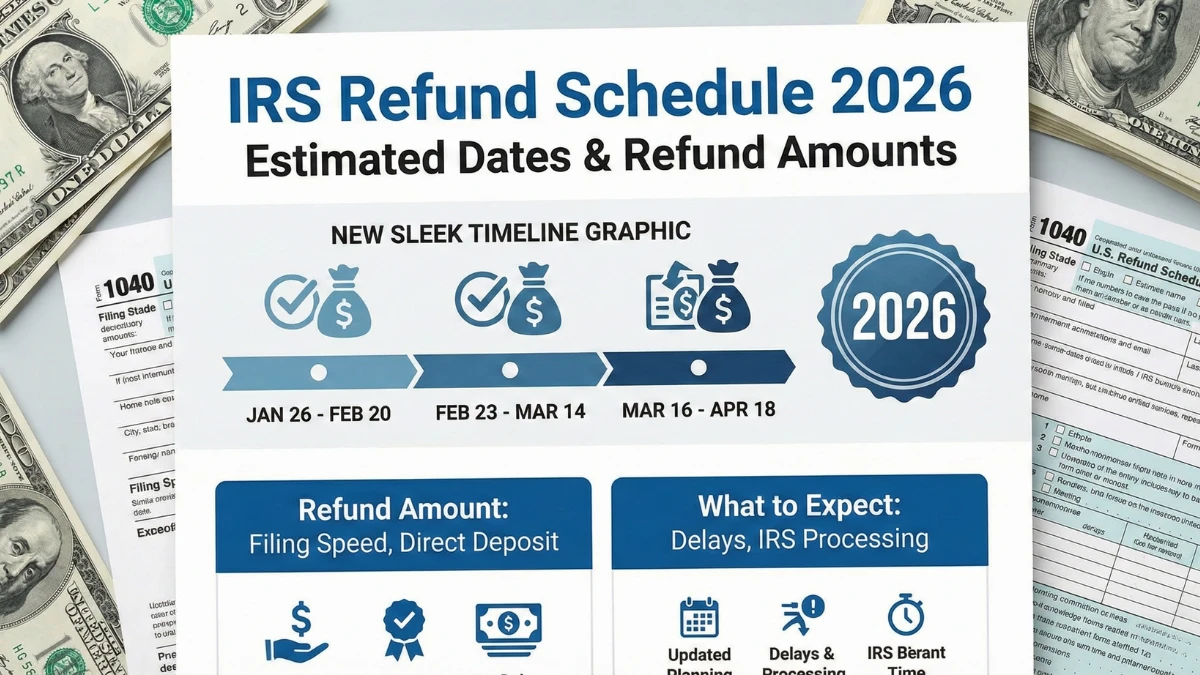

IRS Refund Timeline 2026: Estimated Payment Windows, Amount Factors, and What U.S. Taxpayers Should Expect

Interest in the IRS refund schedule for 2026 rises as U.S. taxpayers look for estimated dates and clues about refund amounts. To set accurate expectations, it’s important to know that the Internal Revenue Service does not publish guaranteed refund dates or fixed amounts for individuals. Refund timing and size depend on filing method, credits claimed, … Read more