Searches for an estimated IRS refund date in February 2026 increase every year as taxpayers file early and expect faster payouts. To avoid confusion and false expectations, it is important to understand that the Internal Revenue Service does not publish fixed refund dates for individual taxpayers. Refund timing depends on filing method, accuracy, and IRS processing rules. This article explains the realistic February 2026 refund windows, how the schedule works, and what can delay or speed up payment.

Does the IRS Release an Official February 2026 Refund Schedule

No. The IRS does not issue an official refund calendar with guaranteed dates. Refunds are processed on a rolling basis after returns are accepted. Any exact-date charts circulating online are estimates, not official schedules.

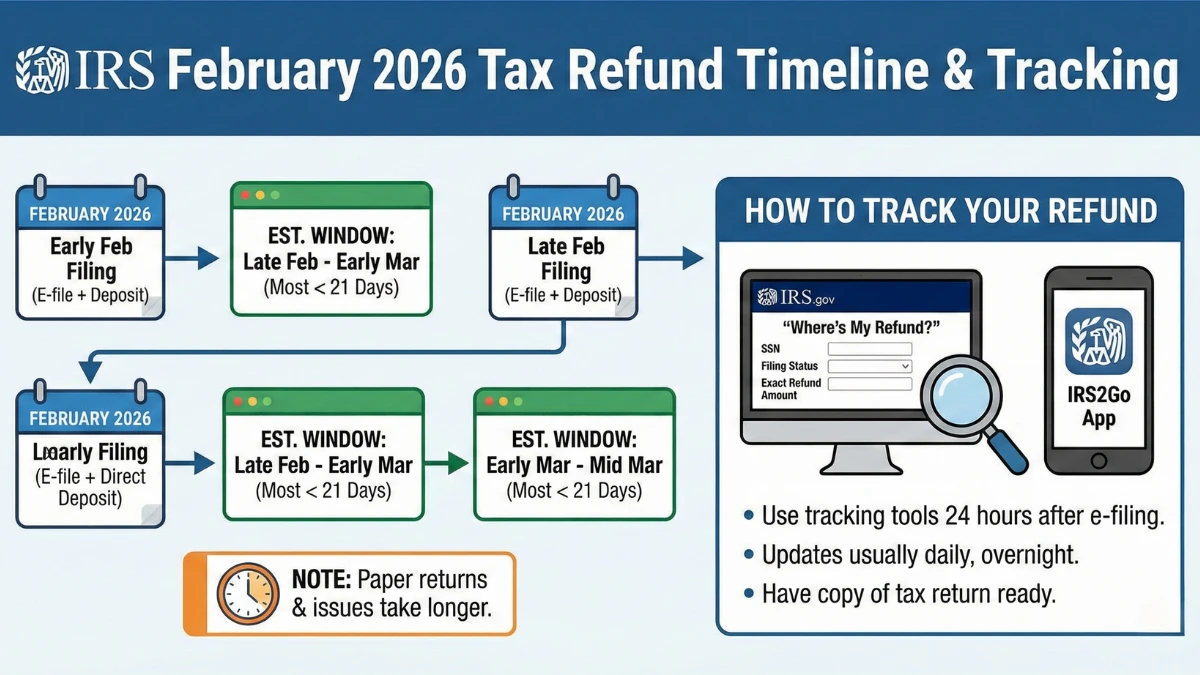

Estimated February 2026 Refund Windows (Based on IRS Practice)

| Filing Situation | Likely Refund Timing |

|---|---|

| E-file + direct deposit | Around 21 days after acceptance |

| E-file + paper check | Longer than direct deposit |

| Early filers (late Jan) | Early to mid-February |

| Returns with credits | Mid to late February |

| Paper-filed returns | Several weeks or more |

How the IRS Refund Process Works

After a return is accepted, the IRS runs automated and manual checks to verify income, withholding, and credits. Once processing is complete, refunds are released to the Treasury for payment. Banks then determine when funds appear in accounts.

Why Some February Refunds Are Delayed

Refunds may take longer if a return includes errors, missing information, identity verification, or refundable credits that require extra review. These delays are procedural, not penalties.

How to Check Your Refund Status

Taxpayers can check refund status using official IRS tools after e-filing. Status updates show whether the return is received, approved, or sent for payment. A delay does not mean the refund is denied.

What Does Not Affect Refund Timing

Routine tax law changes, annual inflation adjustments, or speculation about new payments do not delay refunds unless officially announced by the IRS.

Key Facts

- IRS does not guarantee refund dates

- Direct deposit is usually the fastest option

- Most refunds arrive within about 21 days

- Credits and reviews can delay payment

- Bank posting times vary

Conclusion

The IRS February 2026 refund timeline follows standard processing rules rather than a fixed schedule. While many early filers may see refunds in February, exact dates depend on individual return details. For accurate updates, taxpayers should rely only on official IRS status tools.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund timing depends on individual filings, IRS procedures, and official government operations.

hellloo