As the 2026 tax season approaches, many U.S. taxpayers are searching for clarity on the IRS refund timeline, expected payment windows, and why refund amounts can vary from year to year. To avoid misleading claims, it is important to understand that refunds follow established IRS processing rules, not fixed payout dates. This article explains the realistic refund timing, the key factors that affect refund amounts, and what taxpayers should expect based on guidance from the Internal Revenue Service.

Is There an Official IRS Refund Schedule for 2026

The IRS does not publish a guaranteed refund calendar with exact dates. Refunds are issued on a rolling basis after tax returns are accepted and processed. Any source promising specific refund dates for all taxpayers in 2026 should be treated cautiously unless confirmed by the IRS.

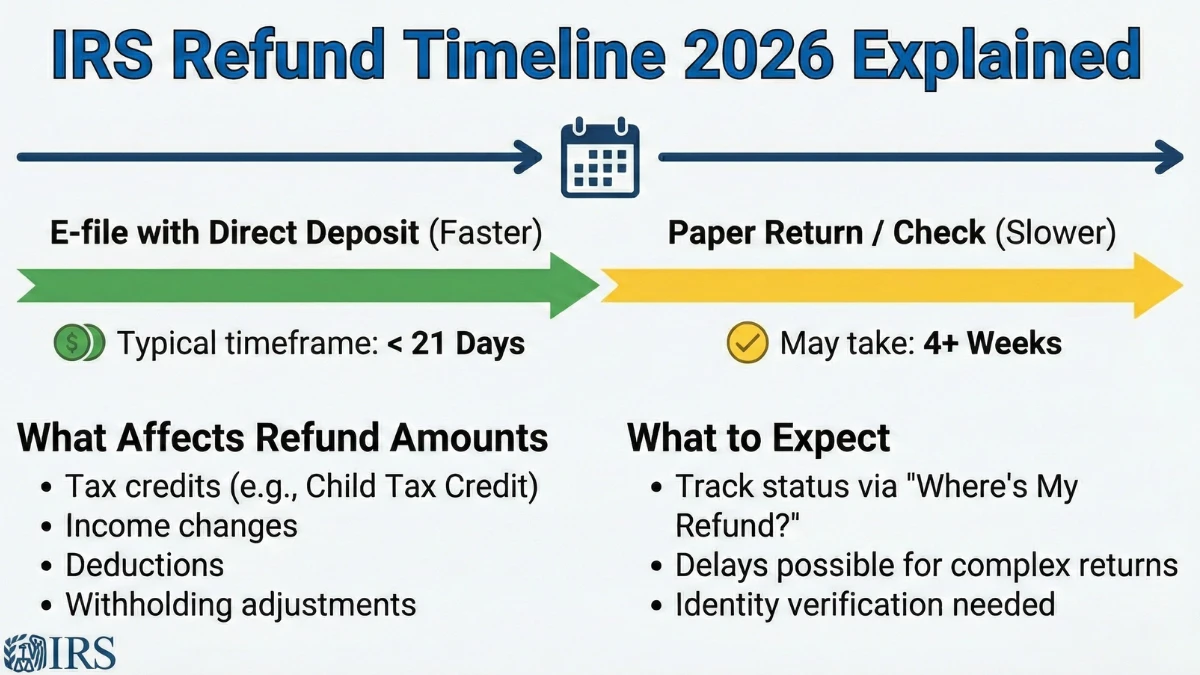

Estimated IRS Refund Payment Windows

| Filing Method | Typical Time After Acceptance |

|---|---|

| E-file with direct deposit | Around 21 days |

| E-file with paper check | Longer than direct deposit |

| Paper-filed return | Several weeks or more |

| Amended return | Significantly longer |

| Return under review | Timing varies |

What Affects the Amount of Your Refund

Refund amounts are not fixed and depend on individual tax situations. Changes in income, withholding, tax credits, deductions, and life events such as marriage or dependents can all impact the final refund figure.

Common Reasons Refunds Take Longer

Refund delays usually occur due to errors, missing information, identity verification, amended returns, or credits that require additional review. These delays are procedural and not related to new payment rules or benefit programs.

How and When Refunds Are Issued

Once approved, refunds are sent via direct deposit, paper check, or prepaid debit card, depending on the option selected when filing. Direct deposit is typically the fastest method, but posting times depend on the taxpayer’s bank.

How Taxpayers Can Track Refund Status

Taxpayers can monitor refund progress using official IRS tracking tools after their return is accepted. Status updates show whether a return is received, approved, or sent, and should not be confused with new payment announcements.

Key Facts

- The IRS does not guarantee refund dates

- E-filing with direct deposit is usually fastest

- Refund amounts vary by individual tax situation

- Reviews and corrections commonly cause delays

- Only official IRS tools provide accurate status updates

Conclusion

The IRS refund timeline for 2026 follows long-standing processing practices rather than a fixed schedule. While many taxpayers receive refunds within a few weeks of filing electronically, timing and amounts vary based on individual filings and verification steps. Relying on official IRS guidance helps taxpayers plan realistically and avoid misinformation.

Disclaimer

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Refund timing and amounts depend on individual tax returns, IRS procedures, and official government regulations.