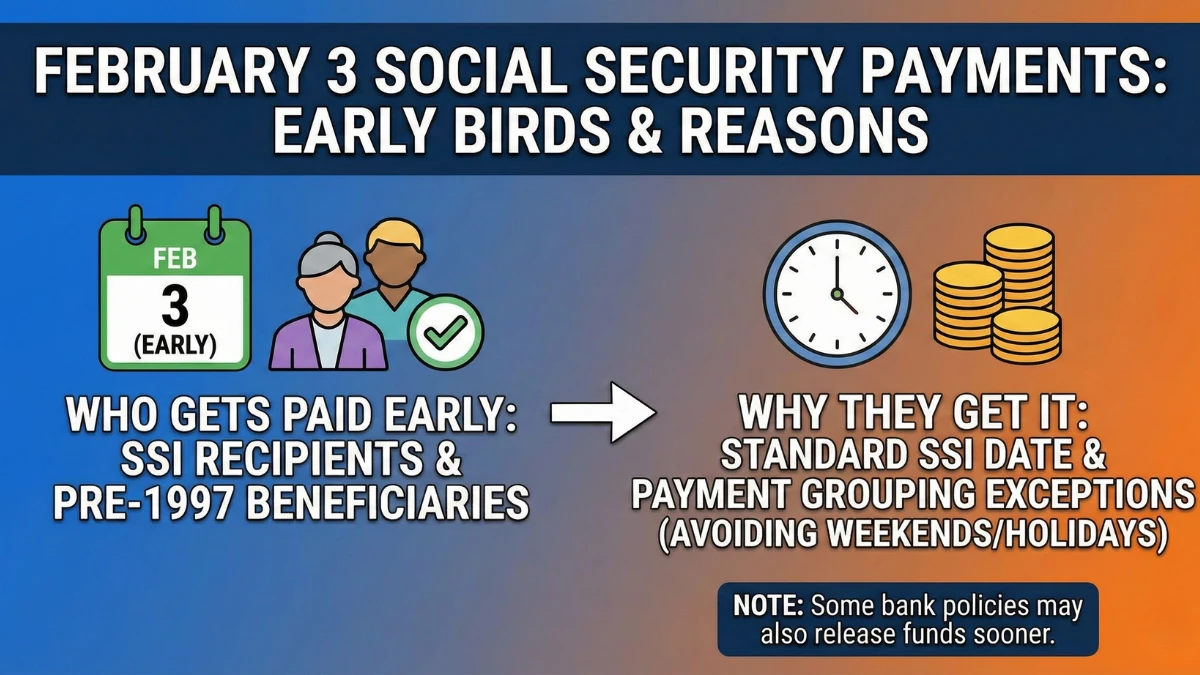

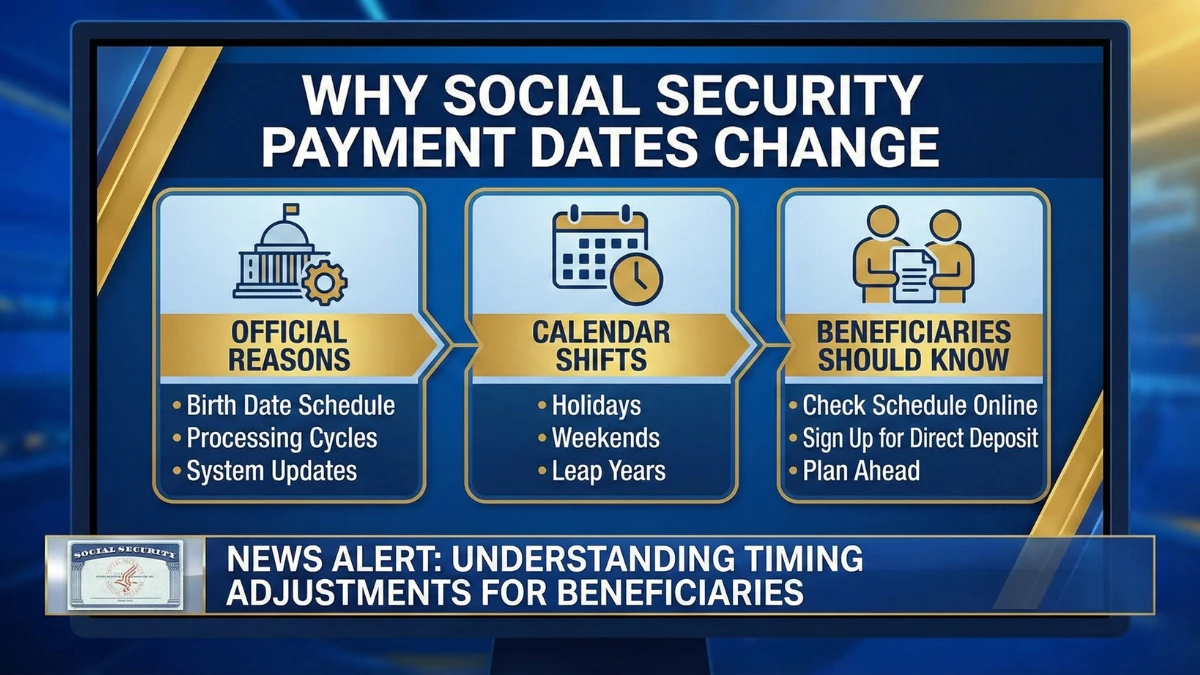

February 3 Social Security Payments Explained: Who Gets Paid Early and Why

Headlines claiming that Social Security payments begin on February 3 with early recipients identified can be confusing without proper context. In reality, February 3 is a standard payment date used by the Social Security Administration for specific categories of beneficiaries under long-standing rules. This article explains who is paid on February 3, why that date … Read more