Interest in the RBA interest rate decision for 2026 is rising as Australian households track mortgage costs, savings returns, and cost-of-living pressures. To keep this accurate and non-misleading, it’s important to note that the Reserve Bank of Australia sets rates based on evolving economic data—there are no guaranteed outcomes. This article provides the official meeting framework, outlines consensus expectations (not promises), and explains how rate moves typically affect households across Australia.

RBA Cash Rate Decisions: How the Process Works

The RBA Board meets regularly to assess inflation, employment, wages, productivity, and global conditions. Decisions are data-dependent and communicated after each meeting. Any change—or pause—is based on achieving price stability while supporting sustainable employment.

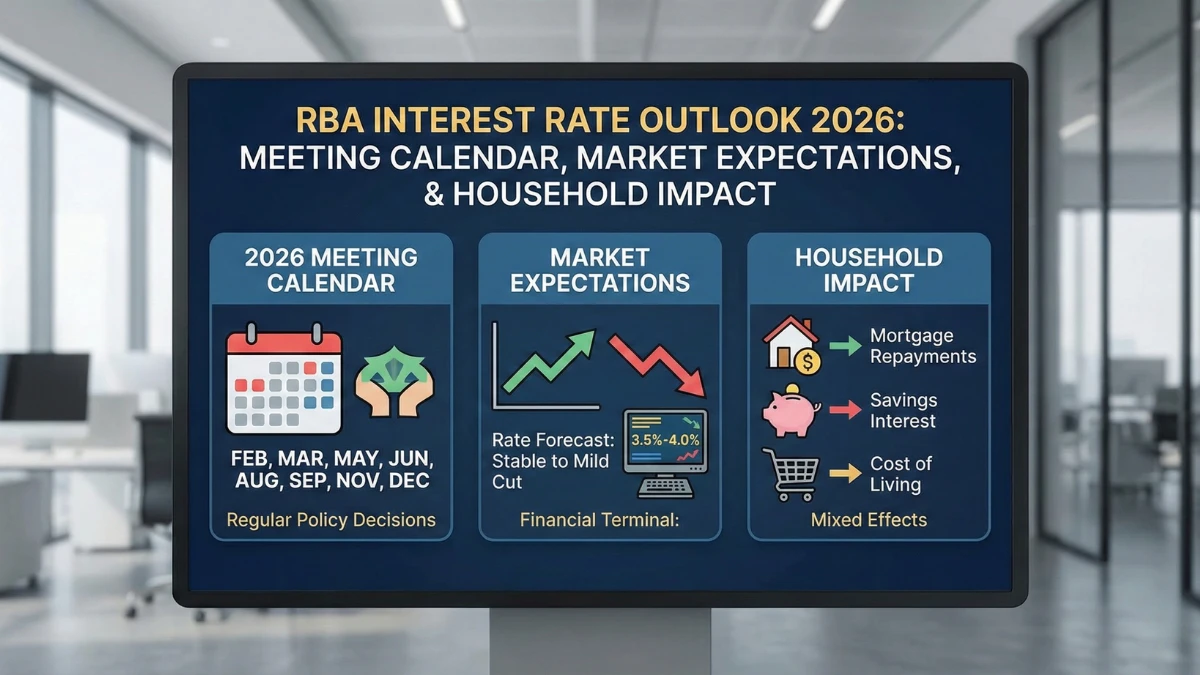

RBA 2026 Meeting Schedule (Indicative Framework)

While the exact dates are published by the RBA annually, meetings generally follow a consistent pattern through the year.

| Period | What to Expect |

|---|---|

| Early year | Review of inflation momentum |

| Mid-year | Focus on wages and growth |

| Late year | Assessment of cumulative effects |

| Post-meeting | Statement and Q&A released |

| Ongoing | Data updates may shift outlook |

Market Expectations vs Official Commitments

There are no official predictions from the RBA. Market expectations reflect economist analysis and futures pricing, which can change quickly with new data. Households should treat forecasts as scenarios, not assurances.

What Influences RBA Decisions Most

Key inputs include inflation trends relative to target, labour market tightness, household spending, global financial conditions, and the transmission of prior rate moves through the economy.

Impact on Australian Households

Rate changes typically affect variable-rate mortgages first, then savings returns and rents over time. Fixed-rate borrowers feel changes when refinancing. The pace and size of impacts depend on household balance sheets and bank pricing.

What Homeowners, Renters, and Savers Should Watch

Homeowners should track variable-rate pass-through, renters should monitor housing supply dynamics, and savers should compare term deposits and high-interest accounts as banks adjust offers.

Key Facts

- RBA decisions are data-driven, not pre-set

- No official rate path is promised for 2026

- Market forecasts can change rapidly

- Mortgage and savings impacts vary by bank

- RBA communications follow each meeting

Conclusion

The RBA’s 2026 interest rate decisions will depend on incoming economic data rather than fixed predictions. Understanding the meeting framework and how rate moves flow through to households helps Australians plan with clarity—without relying on speculative claims.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Interest rate decisions and impacts vary by individual circumstances and official RBA announcements.