Headlines suggesting that Social Security benefits “just got bigger” starting January 2026 can be misleading if taken at face value. In reality, benefit amounts change only through established legal mechanisms, primarily annual cost-of-living adjustments (COLAs) and individual eligibility factors. This article explains the verified facts, how benefit increases are determined by the Social Security Administration, and what beneficiaries should realistically expect in January 2026.

Are Social Security Benefits Officially Increased for January 2026

As of now, no specific benefit increase amount for January 2026 has been officially announced. Any increase would come through the annual COLA process, which is calculated using inflation data and formally announced later in the preceding year. Until that announcement is made, no increase amount is confirmed.

How Social Security Benefit Increases Actually Work

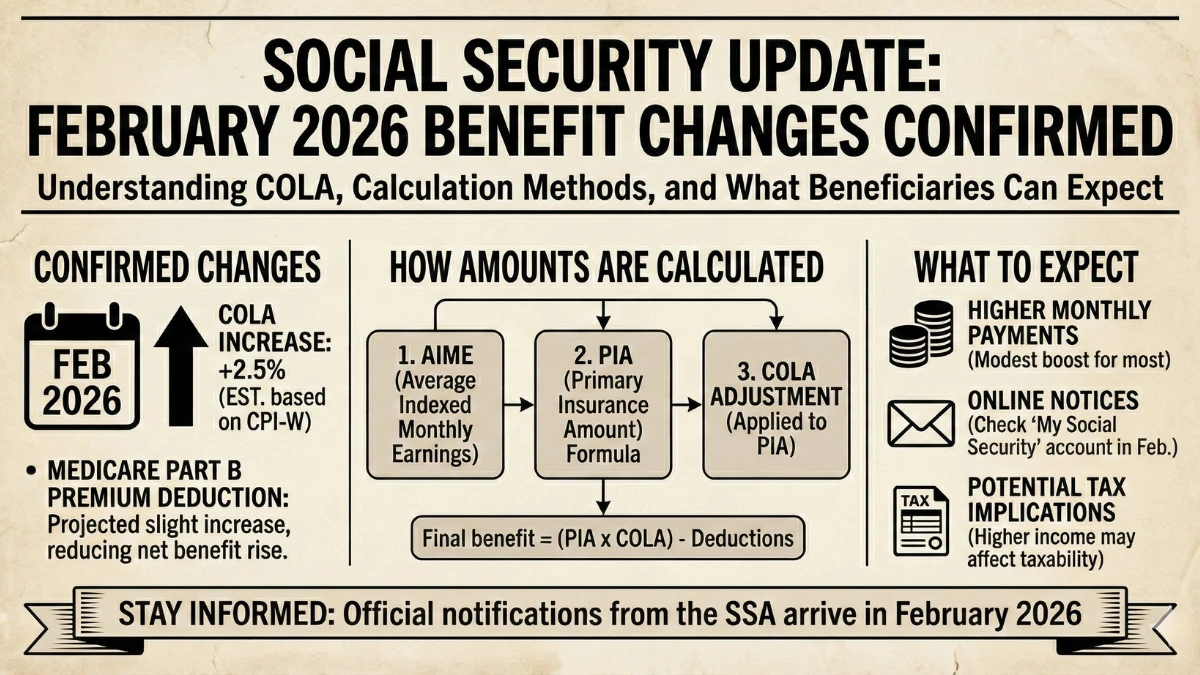

Social Security benefits do not increase arbitrarily or through one-time decisions. Annual adjustments are based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). If inflation meets the required threshold, a COLA is applied uniformly across eligible benefits.

What Determines How Much You Receive

| Factor | How It Affects Benefits |

|---|---|

| COLA percentage | Applies to current benefit amount |

| Claiming age | Earlier or later claiming changes base amount |

| Work history | Lifetime earnings affect benefit level |

| Benefit type | Retirement, disability, survivor |

| Medicare premiums | May offset net increase |

Why January 2026 Is Being Mentioned

January is when COLA-adjusted benefits take effect each year. This timing often leads to assumptions that a new or unusually large increase has already been approved. However, no COLA figure for 2026 is final until officially announced by the SSA.

Who May See a Higher Payment

Beneficiaries may see higher gross payments in January 2026 if a COLA is approved. However, individual net payments can vary due to Medicare Part B premium changes or personal benefit factors.

What Has Not Changed

There is no new law increasing benefits beyond COLA, no special bonus payment, and no automatic recalculation of benefits outside existing rules. Any claim suggesting otherwise should be treated cautiously.

Key Facts

- No confirmed Social Security increase amount for January 2026 yet

- Any increase depends on the official COLA calculation

- COLA applies uniformly, not selectively

- Net payment changes can vary by individual

- Only SSA announcements confirm benefit increases

Conclusion

Social Security benefits may increase in January 2026 through the standard COLA process, but no specific increase has been confirmed yet. Beneficiaries should rely on official SSA announcements to understand how much, if any, adjustment will apply to their payments.

Disclaimer

This article is for informational purposes only and does not constitute financial, legal, or retirement advice. Social Security benefit amounts and adjustments are subject to federal law and official SSA notifications.