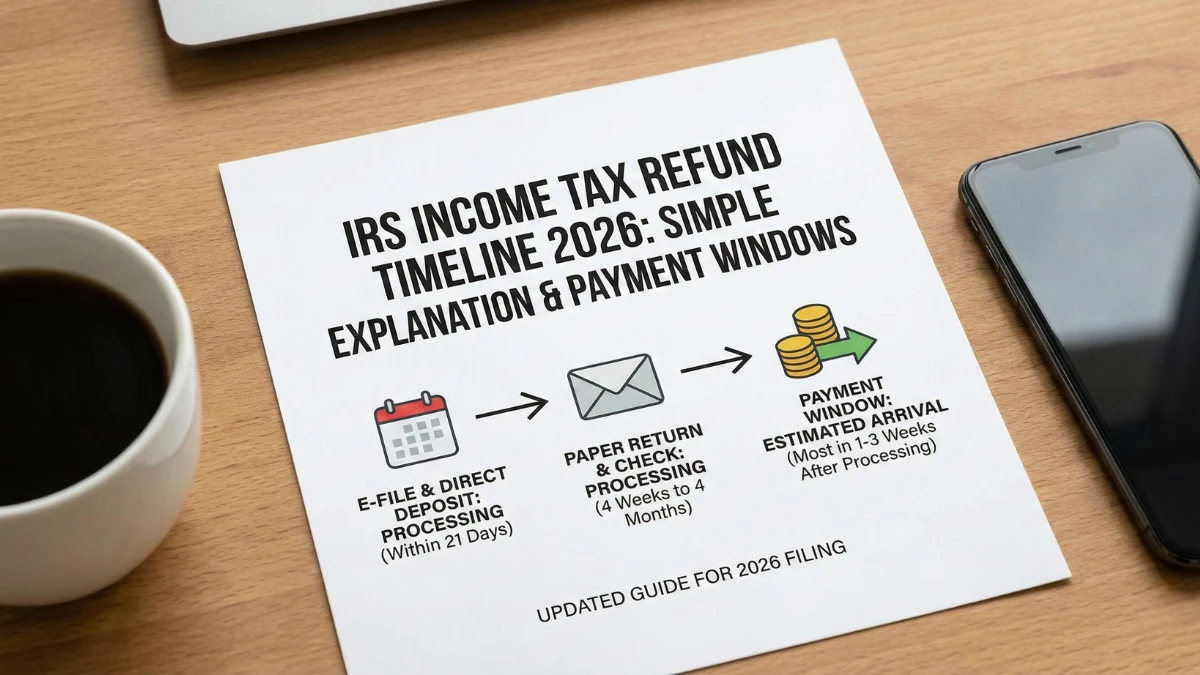

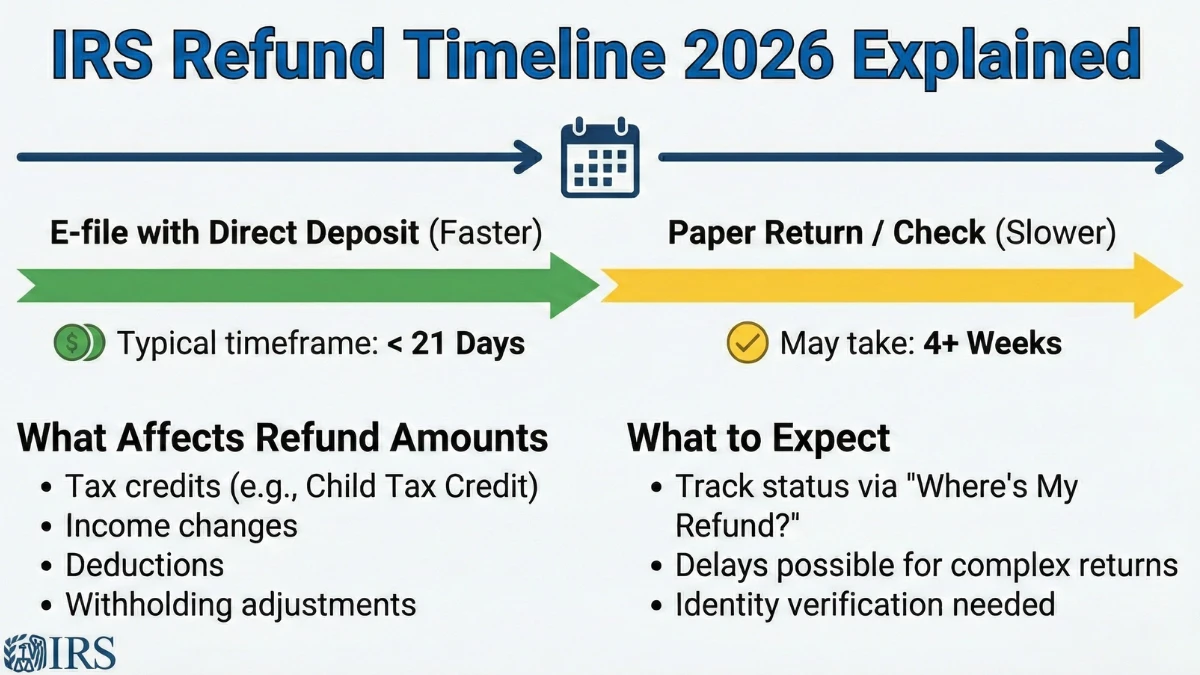

IRS Income Tax Refund Timeline 2026: Simple Explanation of Processing and Payment Windows

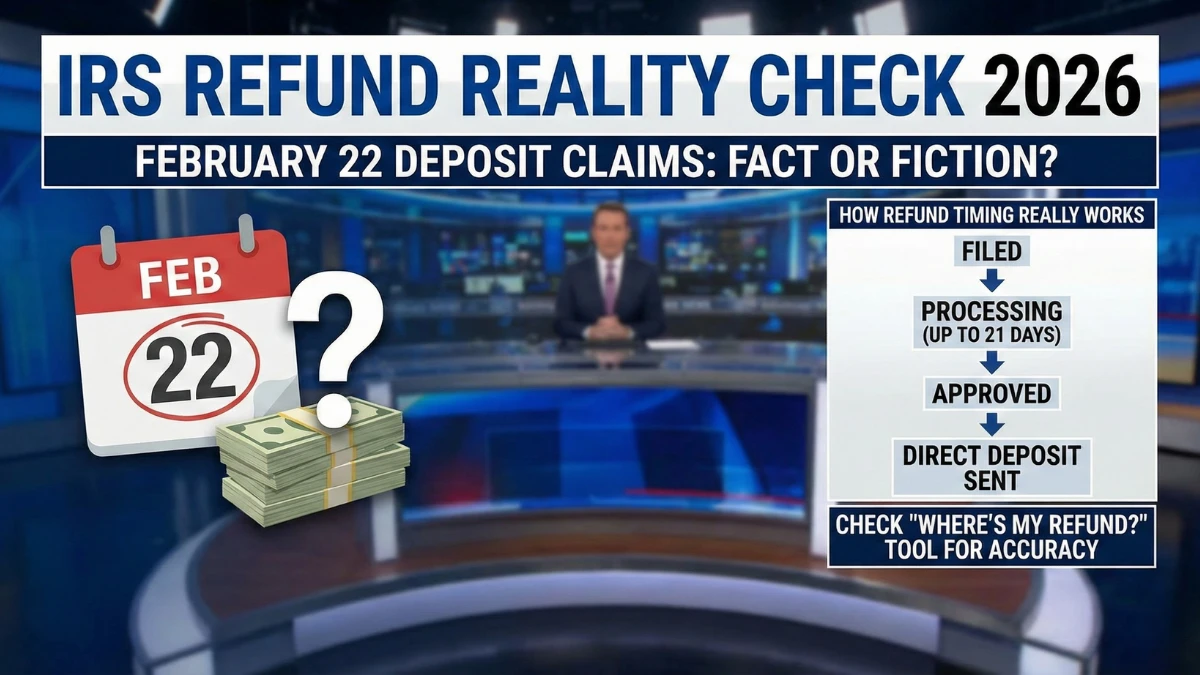

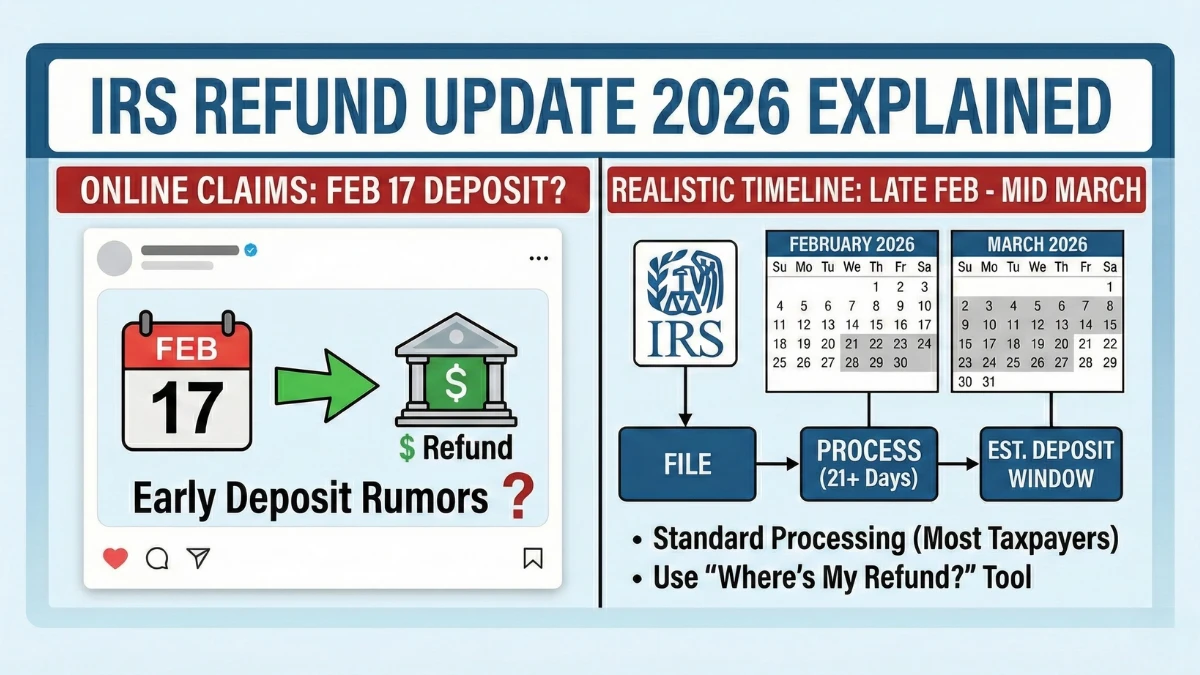

Understanding the IRS income tax refund process for 2026 helps taxpayers set realistic expectations and avoid misleading claims about exact payout dates. Refund timing is not based on a fixed calendar; it depends on how and when a return is filed, accuracy checks, and banking processes. This article explains the simple, verified refund timeline, how … Read more