IRS Refund Processing in 2026: What Is Actually Causing Delays and How Social Security Recipients Are Impacted

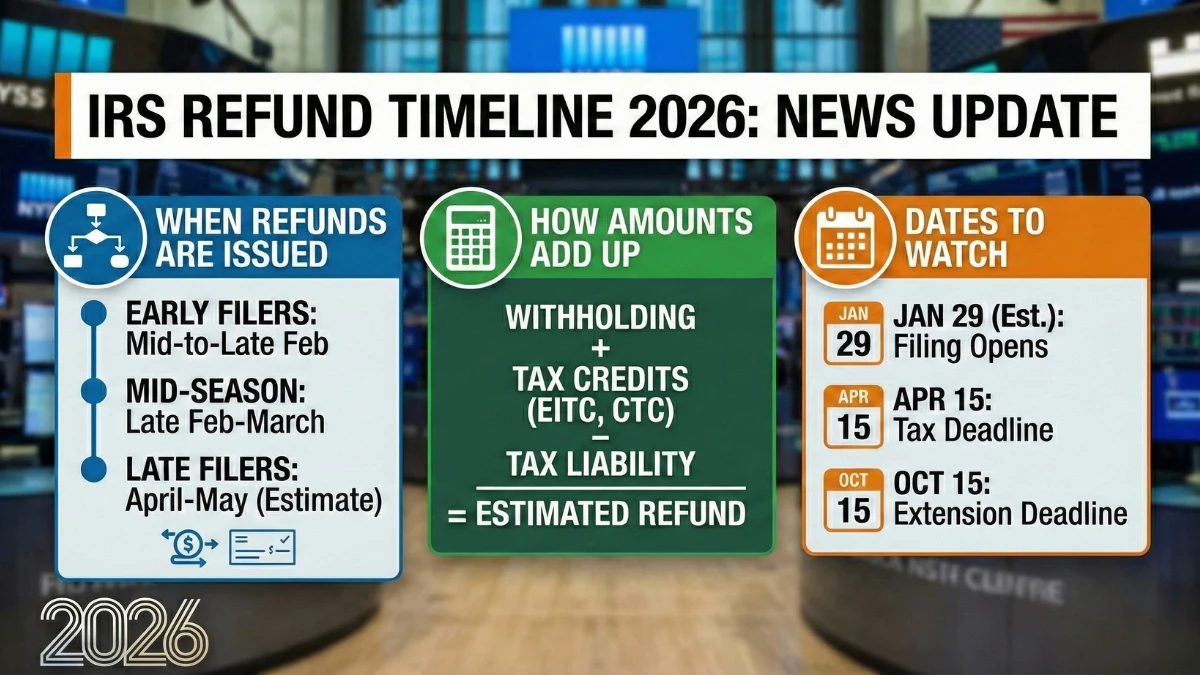

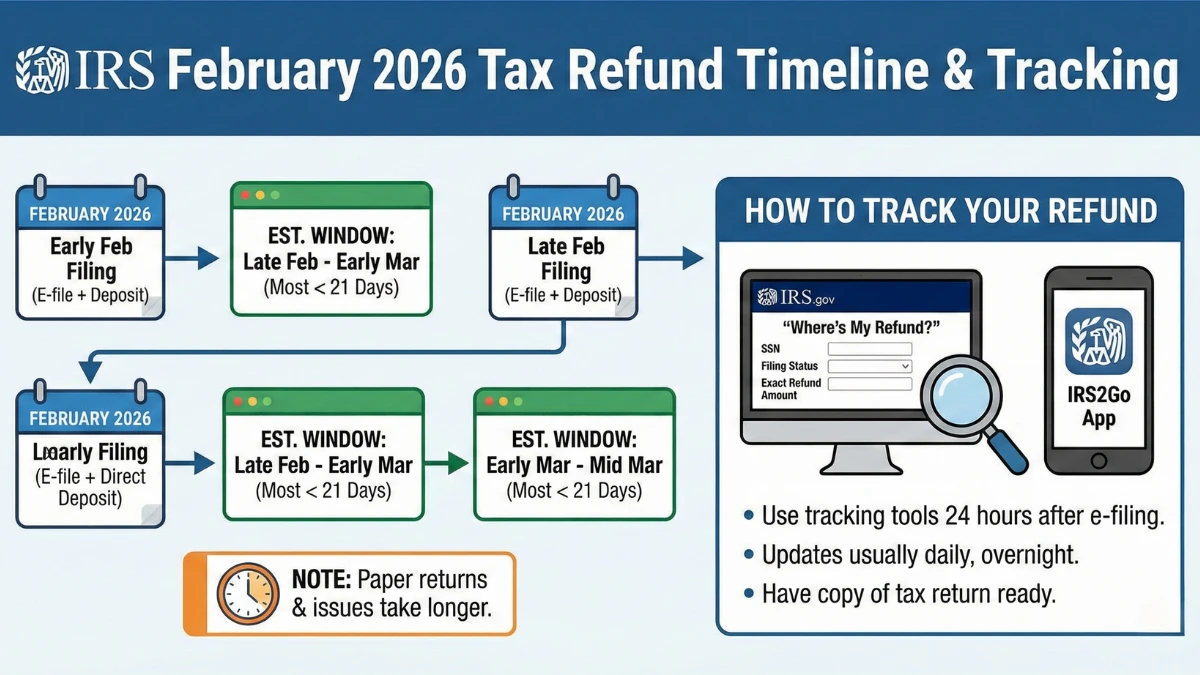

Claims that the IRS has confirmed new federal tax refund delays in 2026 that directly affect Social Security beneficiaries need careful clarification. While refund timing can vary each year due to processing volume and verification steps, there is no special delay policy targeting Social Security recipients. This article explains the verified reasons refunds may take … Read more